Key Changes to Superannuation from 1 July 2025

Effective from 1 July 2025 several key changes to superannuation will take effect, as announced by the Australian Taxation Office (ATO). These updates may impact your payroll obligations, contribution strategies, and retirement planning.

Superannuation Guarantee (SG) Rate Increase

- The SG rate will increase from 11.5% to 12% starting 1 July 2025. This applies to all salary and wages paid to eligible employees on or after this date.

Transfer Balance Cap Increase

- The transfer balance cap will rise from $1.9 million to $2 million. This cap limits the amount of superannuation that can be transferred into a tax-free retirement account.

Contribution Caps Remain Unchanged

The concessional contribution cap remains at $30,000. The non-concessional contribution cap stays at $120,000.

Please note: depending on your personal circumstances and member balance, the above cap limits may not be applicable to you, we would recommend you seek further advice for the above if required.

Maximum Super Contribution Base Adjustment

The maximum contribution base will be $62,500 per quarter in FY2026, down from $65,070 in FY2025. This reflects the SG rate increase and affects the maximum earnings base used to calculate SG obligations.

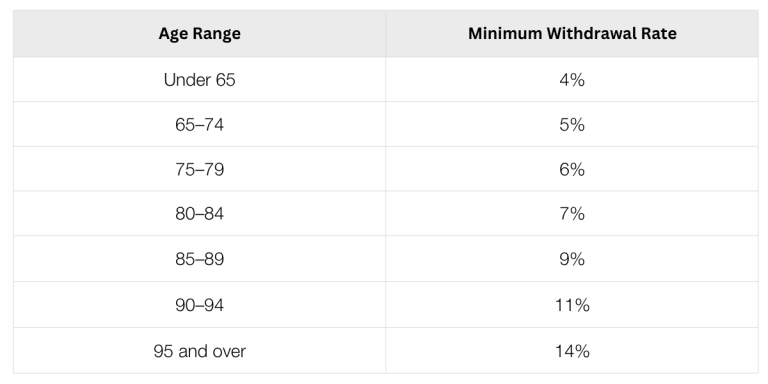

Minimum Pension Withdrawal Rates

For individuals receiving account-based pensions, the following minimum withdrawal rates apply for FY2026:

These rates apply to the account balance as at 1 July 2025. Failure to meet the minimum withdrawal may result in the pension losing its retirement phase status, with potential tax implications.

What You Should Consider:

- Review payroll systems to ensure the new SG rate is applied correctly.

- Update employee communications to reflect these changes.

- Consult your financial adviser or our office to assess how any of the above could affect your retirement strategy.

If you have any questions or need assistance preparing for these changes, please don’t hesitate to contact us.