In this update we examine the strong start to 2021. Progress in vaccination programs has underpinned growth projections, with corporate earnings growth largely offsetting higher interest rate expectations. Australia continues to enjoy good health, a strong recovery in the economy, jobs, and commodity prices. Cyclical stocks have continued to outperform growth stocks, although we suspect this trend is maturing.

Strong Start 2021

Share markets got off to a strong start to 2021 with global indices (MSCI World Index) rising 4.6% during the March quarter. The ASX200 increased 3.1%, with Financials up 11.3%, Consumer Discretionary up 7.4% and Communication Services up 7.1%.

Laggards included Information Technology (down 11.5%), Healthcare and Utilities. As the rollout of COVID-19 vaccination programs gathered surprisingly strong momentum (certainly in the UK and the US), so too did confidence grow on the pace and strength of the global economic rebound. Recently the International Monetary Fund again upgraded its projections for global economic growth from 5.5% to 6%. At the beginning of the year the IMF was forecasting global growth of 5%.

Earnings Growth & Higher Long Term Interest Rate Expectations

One consequence of stronger than anticipated growth prospects has been a sharp increase in long term interest rate expectations (10 year bond yields). During the March quarter, yields in Australia, New Zealand, the USA and Canada increased more than 0.8%. Normally such a steep increase in long term interest rates could be expected to put pressure on share markets. So far that has not been the case. While there have been some sectors negatively impacted (ie long duration assets such as utilities, profitless technology, infrastructure), strength elsewhere has seen markets remain near all-time highs. Strong momentum in corporate earnings expectations have been sufficient to offset the impact of rising bond yields-so far. Citi recently published a chart that highlighted how Consensus earnings estimates for 2021 have increased from 10% a year ago to nearly 30% currently.

While the current economic environment is positive, it is worth remembering that markets are forward looking. To keep some perspective, it is worth considering how some of the key factors such as interest rates, inflation, and fiscal policy may be at the end of 2021. On the balance of probabilities, it would seem reasonable to expect interest rates to be higher at year end, similarly for inflation. Central banks are more likely to be reducing stimulus. Governments in the US and the UK have already foreshadowed tax increases, and others are likely to follow. After an exceptionally strong rebound in GDP and corporate earnings through 2021, a more “normal” outlook for 2022 could reasonably be expected. Perhaps the most important investment conclusion from this is to ensure investment strategy is biased towards longer term growth trends.

Australia well positioned, but China remains a risk

Australia has found itself in a very favourable position. COVID-19, while challenging in some places, generally has been far less disruptive than in most other developed countries. Strong financials have enabled the government to provide a substantial assistance program that provided the basis of a strong economic rebound.

The recovery is broadly based, covering housing, infrastructure, commodities, agriculture, non-residential construction, jobs growth and more recently services including domestic tourism. Personal financial conditions are in good shape courtesy of government support programs, extraction of funds from retirement savings accounts and reduced consumption (no overseas travel, reduced dining out).

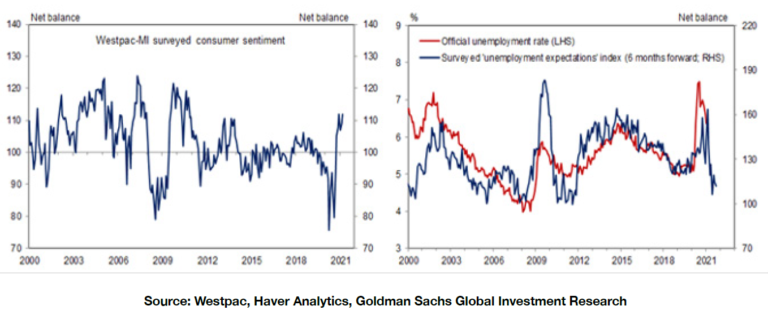

Australian consumer sentiment increased +6.2% to 118.8pts in April, driven by stronger perceptions of future economic conditions. The index is now +23% above its pre-pandemic level and ~8% above its average level over the past two decades.

Australian employment rose in May, with the unemployment rate falling to 5.5%. The data were stronger than expected and consistent with a relatively rapid recovery in Australia’s labour market. To put this into context in August last year the RBA was forecasting Australia’s unemployment rate to be 9% to 9.5% in Q1 2021. That said, the end of Job Keeper is likely to moderate the improvement ahead, and see the unemployment rate temporarily lift by 0.25% to 0.50% during the June quarter. However, we remain optimistic the recovery will remain resilient, supported by further drawdowns of savings to pre-COVID ratios.

China remains an issue for Australia. While our overall trade position remains robust despite a number of bans on the likes of wine, lobsters, barley etc., risks continue to build. China accounts for around 40% of our exports, with iron ore being the largest.

Chart 1 and 2: Australian Consumer sentiment remains elevated, while unemployment expectations point to a sharp decline in unemployment over 2021

Investment Outlook

The outlook for equity markets including the Australian market remain favourable. Corporate earnings growth continues to be upgraded, providing solid fundamental support. Upgrades continue to run ahead of downgrades. On Macquarie Research estimates, the 12 month forward PE for the ASX200 has remained relatively stable around 18-19x, despite the rise in the index.

Following the increase in long term interest rate expectations over the March quarter, we see a period of consolidation in rates as the most likely outcome in the period ahead. The RBA again re affirmed that they do not expect to be increasing the cash rate for at least three years. This, together with higher earnings should ease some of the near term pressure on valuations.

Cyclical stocks have continued to outperform growth stocks, although we suspect this trend is maturing. Over the last 6 months the strongest performing sectors have been Banks and Resources. After performing very strongly for the prior 12 months, growth sectors such as Healthcare, Information Technology and Consumer Staples underperformed in the most recent two quarters.

While much of the relative outperformance of banks and resources has been driven by strong earnings growth and improved dividend prospects, these trends are expected to moderate heading into 2022. Conversely Healthcare and Information Technology appear set to enjoy improving earnings momentum heading into 2022, providing the basis for improved relative performance.

It has been a similar story in the US where, over the last quarter the technology based NASDAQ underperformed the more broadly based S&P500: the former delivered a return of 2.8%, the latter 5.8%. Leading technology and healthcare stocks have started to reverse this trend in early April.

Portfolio Strategy Focused on Long Term Thematics

Through much of the equity market recovery phase, just to own shares served investors well. Given the strength of the rally experienced since the March 20 lows, we see a need to be much more selective around stocks and sectors in the period ahead.

While we continue to see opportunities in the “opening up” space such as travel, leisure, hospitality, the most attractive investment prospects are based around long term, secular growth trends.

These include growth in infrastructure, digitalisation, robotics, e-commerce, logistics, and healthcare. We continue to be overweight growth sectors-Technology, Healthcare, Logistics, and in Cyclicals prefer Materials, Banks and On-line services.

We retain our portfolio strategy based around holding companies that provide exposure to these secular growth trends and have reasonable earnings predictability, sustainable cashflows, strong balance sheets and management capable of generating consistent returns on capital.

If you would like to discuss any of the matters addressed in this update please do not hesitate to contact our office.

Level 1 6 Riverside Quay, Southbank VIC 3135

(03) 9693 5000

office@dfknugents.com.au